For many Non-Resident Indians (NRIs) and international investors, the Indian real estate market might seem complex, even daunting. Perhaps outdated perceptions, concerns about market volatility, or simply a lack of clear information lead some to shy away. However, by overlooking the burgeoning opportunities in real estate investment in India, you might be missing out on one of the most promising avenues for wealth creation.

Let’s delve into why considering an NRI buying property in India and making an NRI investment in India real estate right now could be a strategic move for your financial future.

The India Story: A Foundation for Growth

India is on an undeniable growth trajectory. With a rapidly expanding economy, a young and aspirational population, and significant government initiatives pushing infrastructure development, the foundations for a thriving real estate market are stronger than ever.

Economic Resilience: Despite global economic headwinds, India has consistently demonstrated robust economic growth. This stability translates into increased purchasing power and demand for both residential and commercial properties.

Demographic Dividend: India’s large and young population is entering its prime earning and home-buying years. This demographic dividend ensures a sustained demand for housing across all segments.

Urbanization: Rapid urbanization continues to drive people from rural to urban centers, leading to an ever-increasing need for quality housing and commercial spaces in cities.

Key Drivers Fueling India’s Real Estate Market

Several factors are making India’s real estate market particularly attractive for investors:

Increased Transparency and Regulation: The implementation of the Real Estate (Regulation and Development) Act, 2016 (RERA), has brought unprecedented transparency and accountability to the sector. This has significantly boosted buyer confidence, especially for NRIs who might have previously been wary.

Affordable Interest Rates: Historically low home loan interest rates make property acquisition more accessible and affordable, stimulating demand.

Government Incentives: The Indian government continues to introduce policies and schemes to promote affordable housing and infrastructure development, which indirectly benefits the entire real estate ecosystem.

Infrastructure Boom: Massive investments in national highways, metro rail networks, airports, and smart cities are not only improving connectivity but also opening up new growth corridors for real estate development. Imagine the impact of a new metro line on property values in its vicinity! Massive investments in national highways, metro rail networks, airports, and smart cities are not only improving connectivity but also opening up new growth corridors for real estate development. Imagine the impact of a new metro line on property values in its vicinity!

NRI-Friendly Policies: The Indian government has made it easier for NRI real estate investors to buy, sell, and manage properties. Repatriation of rental income and sale proceeds is streamlined, making the investment process smoother.

Why Now is the Time for NRI Real Estate Investment?

Many NRIs often consider investing in properties in their current country of residence. While that has its merits, the potential for appreciation and rental yields in India often outpaces many developed markets.

High Appreciation Potential: With strong underlying demand and ongoing development, property values in key Indian cities are poised for significant appreciation over the medium to long term.

Attractive Rental Yields: Growing rental demand, especially in metropolitan and tier-2 cities, offers attractive rental yields, providing a steady stream of passive income.

Diversification: Investing in Indian real estate offers an excellent way to diversify your global investment portfolio, hedging against market fluctuations in other regions.

Emotional Connect: For many NRIs, owning a property in India is not just a financial decision but also an emotional one, providing a tangible link to their roots and a potential home for future returns.

Don’t Let Misconceptions Hold You Back

Avoiding Indian real estate investment based on old perceptions or general global advice might be costing you significant financial gains. The market has matured, regulations have improved, and the growth story of India is compelling.

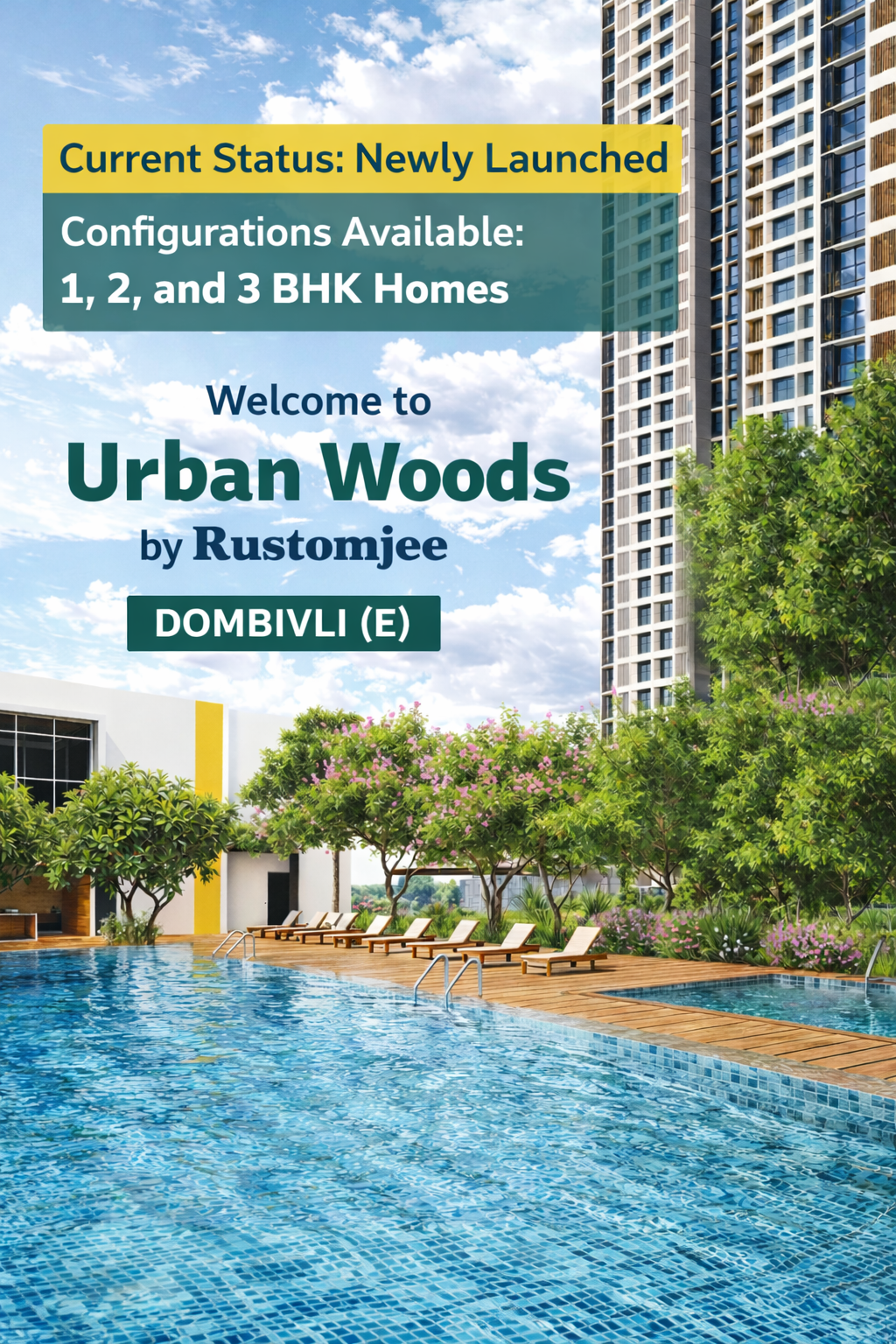

Take the time to research, consult with experts, and explore the opportunities. A trusted developer like Rustomjee can be your guide and partner in navigating this exciting market, ensuring your NRI investment in Indian real estate is not just secure but also highly rewarding.

In conclusion, ignoring the potential of Indian real estate is no longer a prudent financial strategy. For NRIs and international investors, the time is ripe to capitalize on India’s growth story. Explore, invest, and secure your financial future with confidence.